What’s Employee Retention Tax credit

To support the businesses during these tough times of COVID19 pandemic, the Government in the United States brought a breather for the businesses known as “Employee Retention Tax Credit”.

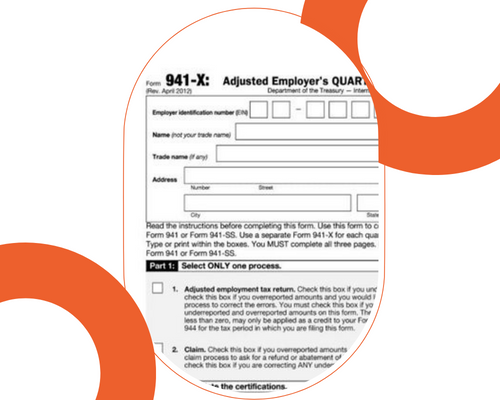

Employee Retention Credit is a refundable tax credit against employment taxes equal to 50% of the qualified wages an eligible employer pays to employees after March 12, 2020 but before January 1, 2021 and 70% of the qualified wages an eligible employer pays to employees after December 31, 2020 but before January 1, 2022.